Join us August 27th for an AIA-accredited live virtual meetup on the 179D and 45L tax incentives.

Register Now

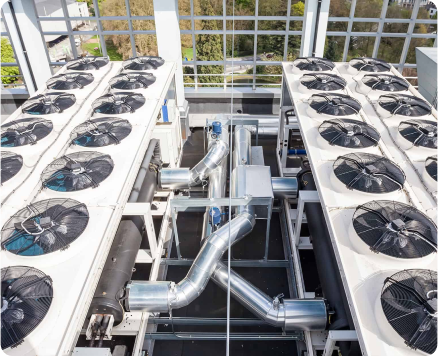

Building owners in Massachusetts who make energy-efficient improvements to their properties can unlock substantial tax savings through the 179D deduction. Whether you own a small office building, a retail space, or a large industrial complex, this tax incentive allows you to reduce your tax burden by implementing environmentally sustainable upgrades. The 179D deduction rewards you for making energy-saving changes such as upgrading to energy-efficient lighting systems, improving HVAC systems for optimized heating and cooling, or installing high-performance insulation that reduces overall energy consumption.

For building owners, the 179D deduction offers a powerful way to recoup a portion of the capital investment required for these upgrades. By qualifying for up to $5.00 per square foot in deductions, owners can realize immediate and long-term cost savings, both in terms of reduced energy bills and tax savings. Additionally, energy-efficient buildings can enhance property values and tenant satisfaction, making them more attractive to environmentally conscious businesses or organizations.

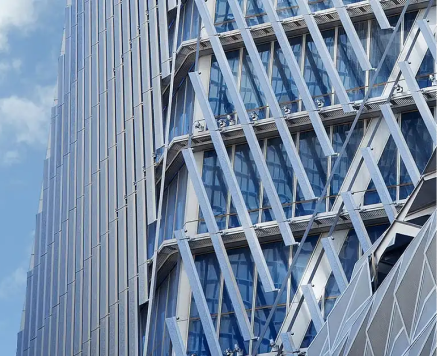

Architects and engineers in Massachusetts play a crucial role in the design and construction of energy-efficient buildings, and they too can benefit from the 179D tax deduction. While traditionally the deduction has been claimed by building owners, the 179D deduction also provides unique opportunities for architects, engineers, and contractors working on government-owned properties. When these professionals design energy-efficient features—such as advanced lighting systems, high-efficiency HVAC systems, and building envelopes for government-owned or public-use buildings—they are eligible to claim this deduction for their contributions to reducing energy consumption.

The 179D deduction is a key incentive for architects and engineers looking to promote sustainable design practices. It not only provides financial benefits but also supports your reputation as a leader in green building. Whether you're designing new government buildings or retrofitting existing ones, the 179D deduction offers a chance to claim up to $1.80 per square foot for energy-efficient design. This makes it an attractive incentive for firms looking to increase their project margins while contributing to sustainable development goals.

In addition to the 179D tax deduction, Massachusetts offers numerous energy-efficiency incentives to encourage the use of clean energy technologies and reduce the costs of energy-efficient building improvements.

Massachusetts has implemented a range of green building standards and energy codes to promote sustainability and energy efficiency. These regulations help building owners and developers comply with state environmental goals and qualify for tax incentives like the 179D deduction.

The Massachusetts Building Energy Code establishes energy efficiency requirements for new and existing buildings, ensuring that construction projects meet minimum energy performance standards.

This standard requires state-funded construction projects to meet or exceed LEED certification while incorporating energy efficiency and renewable energy technologies.

These laws protect property owners’ rights to install and maintain solar energy systems by granting solar access easements, ensuring that future developments do not block sunlight to installed solar panels.

Boston’s Green Building Standard sets energy efficiency and sustainability criteria for large construction projects, promoting environmentally friendly development and reduced energy use in the city.

Our specialized accounting and engineering teams have been securing these tax incentives for over a decade. Our highly specialized experience means your business is positioned for the maximum amount of benefit, with the confidence that you've got an accurate and complete deliverable every time. So far we have completed thousands of studies and saved our clients more than $100 million.

We also respect and want you to keep your existing accountant and bookkeeping relationships. We simply cover specific portions of the federal tax code with the finest precision so your existing teams are well supported and you spend your time doing what you do best: building your company - while getting lots of money back every year!

It is possible that your CPA has taken other deductions but not necessarily the 179D Tax Deduction. Incentives like 179D and 45L require an in person site visit from an engineer that most CPA’s are not qualified to perform.

Yes, the energy incentives in the Inflation Reduction Act (IRA) are legitimate and have been designed to promote investments in renewable energy, energy efficiency, and the transition to a cleaner energy economy.

The Inflation Reduction Act (IRA) introduced several significant updates to key tax incentives, including the Investment Tax Credit (ITC), Section 179D for energy-efficient commercial buildings, Section 30C for alternative fuel vehicle refueling property, and Section 45L for residential energy-efficient property.

The best time to evaluate energy incentives like the 179D deduction, 45L tax credit, and the Investment Tax Credit (ITC) is right at the beginning of your project planning phase. Doing this early allows you to design your project to meet specific requirements, ensuring you qualify for maximum benefits and can plan your budget effectively. It also helps you integrate energy-efficient technologies and renewable energy systems from the start, rather than retrofitting later, and gives you ample time to gather necessary documentation for compliance.

Working with TaxTaker is risk free. TaxTaker collects a success fee only if you qualify for a tax credit.